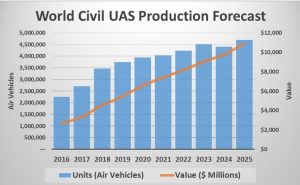

Teal Group Predicts Worldwide Civil UAS Production Will

Total $65 Billion in Its 2016 UAS Market Profile and

Forecast

Fairfax, Virginia – July 7, 2016. Civil Unmanned Aerial Systems (UAS)

promise to be the most dynamic growth sector of the world aerospace industry

this decade, report Teal analysts in their latest market analysis. The emergence

of the commercial UAS market, growth in demand from governments around

the world to better patrol borders, and continued consumer drone growth all

promise to drive more than a quadrupling of the non-military market over the

next decade.

Teal Group’s 608-page, 2016 World Civil UAS Market Profile and Forecast estimates

that non-military UAS production will soar from $2.6 billion worldwide in

2016 to $10.9 billion in 2025, a 15.4% compound annual growth rate in

constant dollars. Over the next decade the market totals $65 billion.

Commercial UAS Market

“The commercial segment of the worldwide market will lead growth in civil

UAS,” said Philip Finnegan, Teal Group’s director of corporate analysis and

author of the study who also has advised the FAA on its forecast for civil

UAS. “Eased airspace regulations, an influx of venture capital investment, the

development of a service industry and involvement of major technology

companies all are creating the foundations for solid growth.” Intel Corp.,

Google and Facebook made acquisitions and now are developing UAS

systems.

Worldwide commercial is projected to grow from $387 million in

2016 to $6.5 billion in 2025, a 32.6% compound annual growth rate.

Construction will lead the commercial market. All 10 of the largest worldwide

construction firms are deploying or experimenting with systems and will be

able to quickly deploy fleets worldwide. The three largest construction

equipment suppliers are all either distributing drones or planning to build

them.

Agriculture, which will adopt UAS more slowly, will still rank second

worldwide. The ability to do unmanned spraying of crops and also do imagery

that can detect when and where to apply fertilizer, pesticides and water offers

tremendous potential. While it grows more slowly than construction, the

agricultural UAS market has the potential to continue to grow considerably

beyond the forecast period.

Low-cost, high-altitude, long endurance UAS for internet promise to create an

entirely new segment of the market. Airbus has already begun low rate

production of solar-powered UAS, and Google and Facebook are also working

on systems. The technology looks likely to be in place within several years to

bring the internet to areas of the world with no service.

Other important segments, ranked in order by ten-year size, include energy,

insurance and general photography such as real estate marketing. There may

be niche applications for delivery UAS during the forecast period such as

deliveries of humanitarian supplies to remote developing areas. Yet regulatory

restrictions and the uncertain economics of delivery make it impossible to

make a forecast for what could potentially be quite a large segment.

Civil Government and Consumer UAS

Civil government UAS will be a much smaller segment than commercial, but

the appeal is growing. The European Union’s creation of a new border and

coast guard in an expansion of its existing Frontex prepares the way for the

use of the unmanned systems. The United Nations is seeking to expand the use

of UAS in peacekeeping. Drones are catching on with public safety agencies

worldwide, particularly in developing countries.

The consumer drone segment will continue to grow although the explosive

increase of the recent past will slow. The continuing increase will be based on

easier to use systems with new capabilities and a broader range of suppliers.

In addition to examining the relative growth rates of the market segments, the

study examines investment trends by venture capital firms, and examines the

strategies companies are using to address the market.

Consumer drone manufacturers are seeking to move into commercial markets

by moving up the value chain. Defense companies are working to develop

smaller, cheaper systems for civil government and commercial use. Start-ups

are seeking to provide everything from data analysis to full service UAS

packages.

The sector study splits out civil systems from Teal Group’s annual UAS

Market Profile and Forecast to provide greater analysis. Now the civil and

military markets will be treated in their own volumes, building on the

experience gained through 12 editions of Teal Group’s UAS study.

World Civil Unmanned Aerial Systems, Market Profile and Forecast 2016,

examines the worldwide requirements for UAS, providing ten-year forecasts

by customer, region, and class of UAS as well as by market.

The Civil edition includes UAS market forecast spreadsheets, permitting data

manipulation and offering a powerful strategic planning mechanism. It also

offers searchable appendices of US and French UAS operators, including the

systems being used and their manufacturers.

Source of text and Graph credit: www.tealgroup.com